FTX US Review

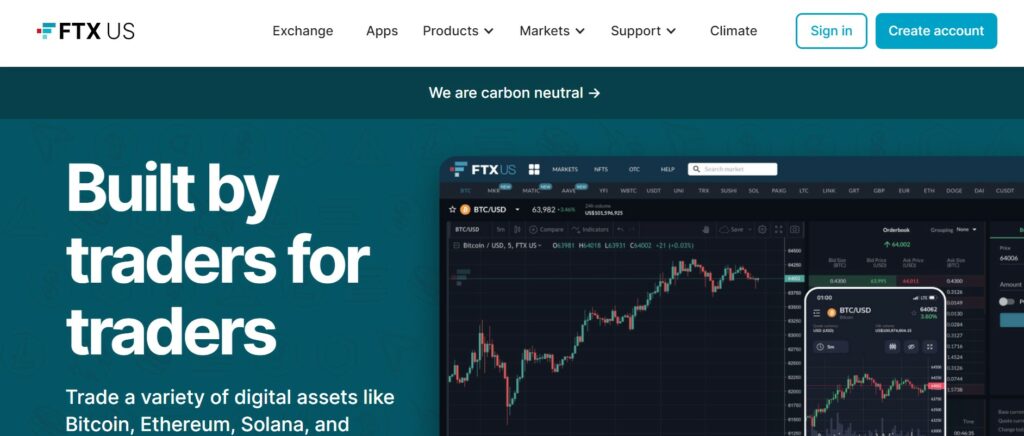

FTX US is a subsidiary company of FTX. It was founded by industry experts from Wall Street and Silicon Valley, and it swiftly rose to become one of the world’s most well-known cryptocurrency exchanges. It is a corporation that was established in Delaware State. It is a cryptocurrency services business that is registered with the Financial Consumer Agency (FinCen). This FTX US review is intended to assist you in making educated decisions about your bitcoin exchange experience in the United States.

Try Bit Revolution with FTX US Today – FREE SIGN UP

Overview of FTX US

FTX US provides a diverse range of specialized products, including options, derivatives, volatility products, and leveraged tokens, all of which are firsts in the market. It’s a brand-new virtual currency exchange platform in the United States built from the ground up from scratch.

FTX US is aimed to grow the cryptocurrency ecosystem over the next 2 years, providing American traders with an exchange platform that encourages them to invest and establish themselves as an industry leader in the cryptocurrency business in the United States. FTX US offers Bitcoin, Ethereum, Litcoin, Bitcoin Cash (BCH), USDT, and PAXG, among other cryptocurrencies, compared to other major United States platforms. FTX US has some of the best liquid derivatives order books in the industry, courtesy to some of the best market makers.

With FTX US, deposit and withdrawal of fiat are rapid and straightforward. USD and stablecoins have been seamlessly integrated into the FTX US platform to boost liquidity and ease of use. The objective of FTX US has been to contribute to some of the world’s most influential organizations since its establishment. Its employees and associates have generated nearly ten million dollars to help alleviate suffering and ensure a bright future.

Try Bit Revolution with FTX US Today – FREE SIGN UP

FTX US Offers Margin Trading

A minimum quantity of assets is required for margin trading. Qualified customers can leverage up to 10x with FTX US’s spot rate. If your profile is Margin Qualified, you can allow margin trading (MQ) on your profile. If you’ve accomplished this step, your user account will have sufficient Margin to place orders that require higher tokens than you currently have. Any negative balance you amass will result in you acquiring a loan and automatically paying interest on the acquired loan. Any pending requests for more than $300,000 per exchange account that exceed the account’s holdings will also require a loan.

Different Fees At FTX US

Transaction costs are an important indicator of whether or not a stock exchange is respectable. No one prefers to incur a significant expense for a trade that results in a smaller profit than the fee. As a result, a cryptocurrency exchange must be able to offer its customers low transaction fees. Customers should be able to finance the charges that they incur.

FTX US retains the right to charge a fee of up to 5.1 per cent for each transaction when making deposits or withdrawals using USD wire transfers. As a result, there is a 1% fee on all USD withdrawals and deposits, albeit the price cannot surpass $35 or be lower than $5. Stablecoin deposits and withdrawals, as well as ACH transfers, are entirely free. Currently, there are no fees associated with wire transactions.

The average cost of an ACH transaction is $0.50. For first-time ACH depositors, there are no costs. If you haven’t performed an ACH deposit in at least a week, there is no charge. If you’ve made a deposit by ACH in the last week and its worth more than $100, FTX US will relinquish the fee.

It is entirely free to use the cryptocurrency blockchain as a payment method. While FTX US does not cover the transaction blockchain expenses for Omni and ERC20/ETH tokens, it does cover all other tokens.

Try Bit Revolution with FTX US Today – FREE SIGN UP

Conclusion

FTX US has distinguished itself as a crypto-exchange platform by providing fresh and innovative products in various areas, including derivatives and matching currency markets. As a result, buyers will be given a profusion of options to consider when deciding between cryptocurrency trading combinations.