Key Insights:

- FTX, a cryptocurrency exchange, announced the recovery of $7.3 billion and may consider reopening its exchange in the second quarter of 2024.

- The FTT market has experienced a significant decline in investor confidence and market activity, leading to a drop in prices by 20.21% over the past 24 hours.

- Since the market is oversold and has significant negative momentum, traders may wish to wait for a trend reversal before taking long bets.

On-chain activity on the FTX market (FTT) has been noticed, revealing a recovery of $7.3 billion. FTX is contemplating reopening its cryptocurrency exchange in the second quarter of 2024, which could be in April. FTX CEO John Ray had reportedly indicated restarting the insolvent exchange during an interview in January.

Selling pressure causes FTX market plunge

The FTX market has been controlled by bears in the last 24 hours, causing a decline in prices from intraday highs of $2.58 to intraday lows of $1.91, with the price currently at $1.95, down by 20.21%. The abrupt price drop is attributed to the elevated selling pressure from investors looking to profit.

The market capitalization and the 24-hour trading volume, previously at $662,699,528 and $130,549,671, respectively, have decreased by 11.69% and 69.93%. These figures demonstrate a significant decline in market activity and investor confidence. It remains to be seen whether the trend will rebound soon or not.

FTT/USD 24-hour price chart (Source: CoinMarketCap)

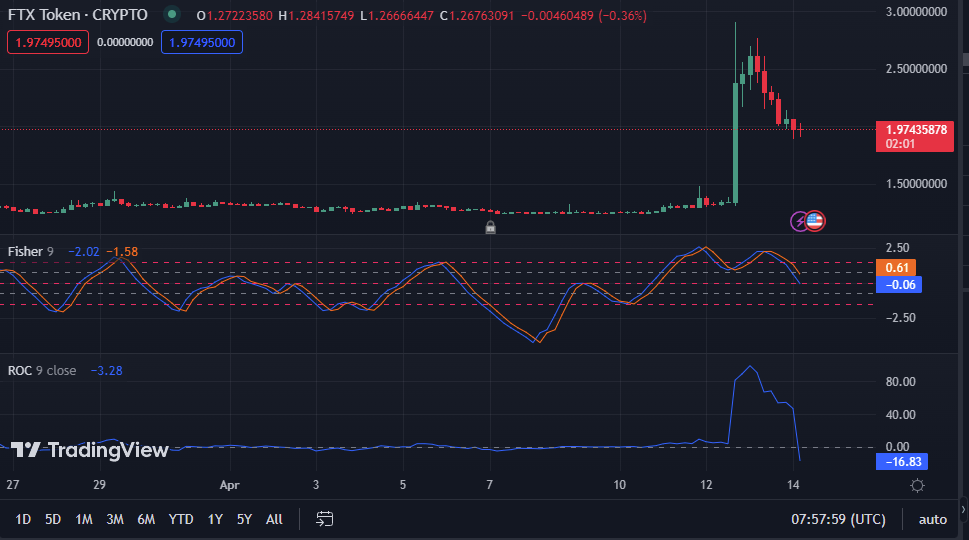

According to the 4-hour price chart in the FTT market, the Fisher Transform value is at -0.06 on the negative side, below its signal line. This indicates a rise in selling pressure, prompting traders to consider going short or waiting for a potential trend reversal before establishing long positions.

The market’s negative momentum is robust, with a Rate of Change (ROC) of -19.05, and it may cause additional declines if the price movement breaches crucial support levels. If the ROC rating improves and enters positive territory, traders may perceive it as a sign of a change in momentum and a chance to buy.

FTT/USD 4-hour price chart (Source-TradingView)

The balance of power on the FTT market displays a considerable negative momentum with a value of -0.46 and a south-facing line. This trend indicates that sellers may have a minor upper hand over buyers in the market, leading to a possible decline in the price trend over time.

The asset is currently considered oversold with a stochastic RSI reading of 3.40 and its movement below the signal line on the FTT market price chart. Traders who believe the asset is undervalued and has the potential to experience a price increase may wish to consider purchasing now, as this indicates a possible buying opportunity.

FTT/USD 4-hour price chart (Source-TradingView)

Conclusion

The prices of FTX have fallen as investor confidence has declined, contributing to a negative balance of power and oversold circumstances in the market. Traders should keep an eye out for a possible reversal in the trend as well as a buying opportunity.