Key Insights:

- The LEO market indicates a positive attitude with rising asset demand and increasing trading volume.

- Traders should wait for a stronger bullish signal before starting a long position in LEO.

- Bearish reversal signals indicate the current rally in LEO is losing strength, and traders should consider taking profits.

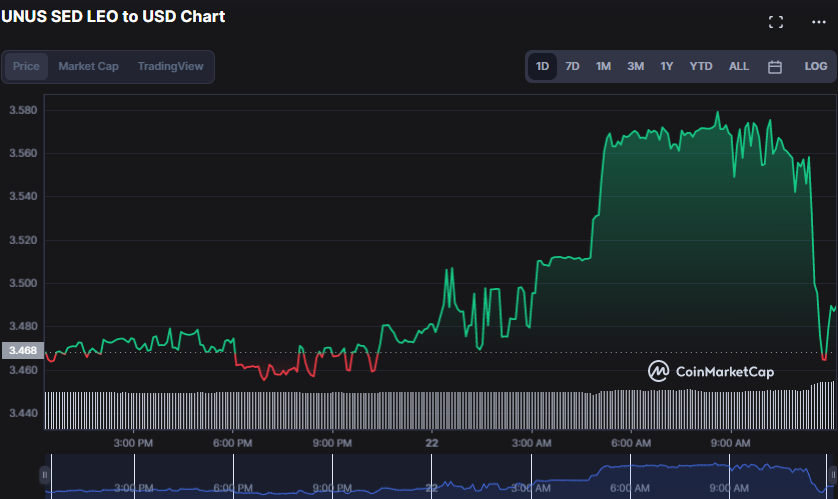

The UNUS SED LEO (LEO) market started with a struggle between bulls and bears for control, with prices oscillating between a high of $3.58 and a low of $3.45 during the first trading session day.

For LEO holders, this 24-hour high, and therefore the new 30-day high, was a promising omen, signifying a possible upward trend in the market. At the time of this writing, the price of LEO was $3.51, representing an increase of 1.27% from the previous day’s closing price.

Market capitalisation and 24-hour trading volume grew during the upswing, reaching $3,268,987,705 and $849,636, respectively. This was a 0.7% and 34.55% gain, respectively. This spike suggests that there is growing demand for assets and that investors are willing to pay greater prices, suggesting an optimistic attitude in the market.

LEO/USD 24-hour price chart (source: CoinMarketCap)

The fact that the actual average range for the LEO market is 0.0382 suggests that the bullish momentum in the market could be stronger, and the fact that price movement is not particularly erratic shows that the market is rather stable.

As a result of this movement, traders should wait for a more powerful bullish signal before beginning a long position because the current market conditions may not give a significant possibility for profit.

A Know Sure Thing level of 20.4498 indicates that the bull’s strength is rather weak, which suggests that buyers may not have sufficient impetus to boost the price soon. This KSI level supports the sell” signal, indicating that traders may consider taking profits or delaying purchases until a more favourable entry point presents itself.

LEO/USD chart (source: TradingView)

A rating of 58.16 on the Relative Strength Index and movement below that indicator’s signal line show that LEO bullishness is now at a minimum level, indicating that investors who desire to enter the market may have a chance to make a purchase.

If the Relative Strength Index (RSI) passes over the signal line, this may suggest a greater upward trend and that it is time to consider growing one’s position in LEO.

This bearish reversal signal has a TRIX value of 6.05, showing that the current LEO surge is losing momentum. Traders should consider taking profits or tightening stop-loss orders in order to protect their gains and consider either taking profits or tightening stop-loss orders.

LEO/USD chart (source: TradingView)

Conclusion

Although there are indications that bullish momentum is building in the LEO market, traders should wait for more precise signals before entering long positions. It is essential to keep an eye on market trends and indicators to make informed decisions. Additionally, traders should consider setting stop-loss orders to minimise potential losses.