Bitcoin: Current Situation

This post is not intended to give super exact data because the main concept is to show the current and potential future situations based on technical and fundamental facts.

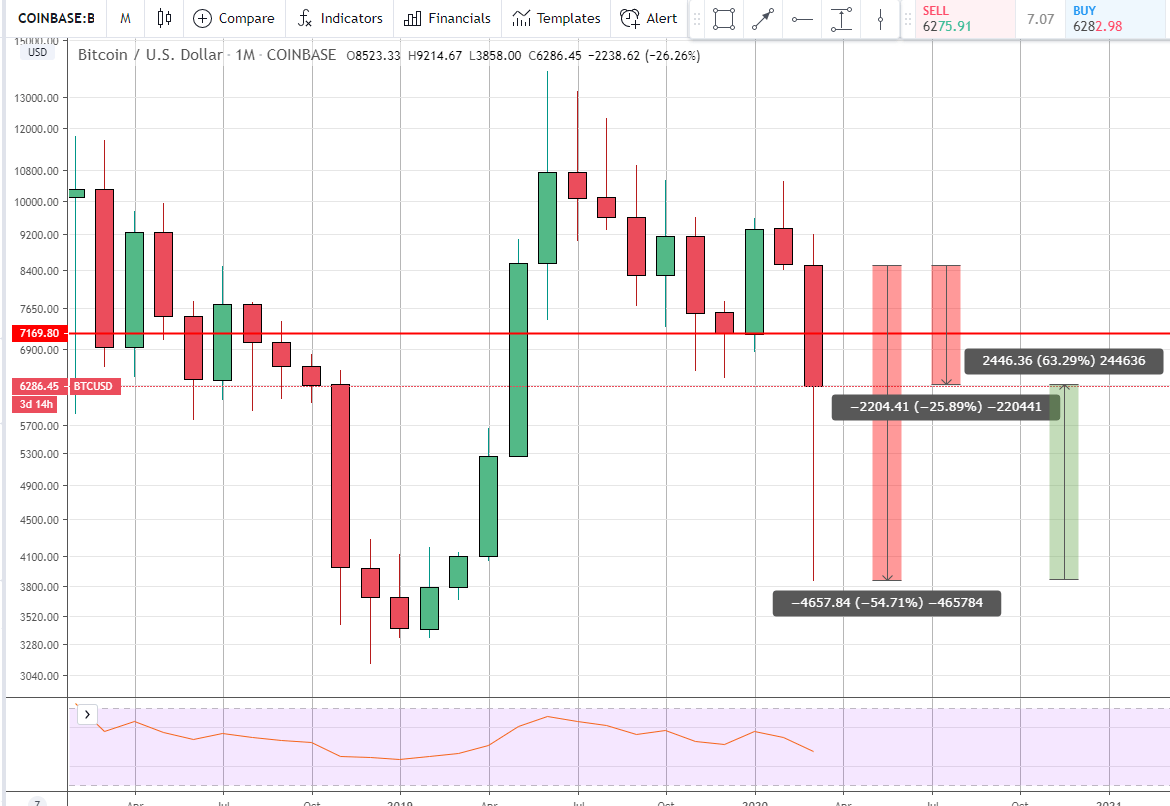

Bitcoin Crashed due the Coronavirus + large amount of short leveraged orders in the beginning of March 2020.

Bitcoin Touched the levels of 3900$ within a single day setting the worst BTC crash ever.

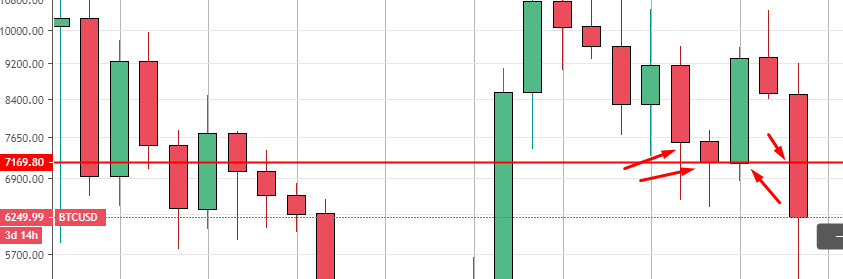

Currently, we see that on the monthly Chart a huge candle down which is recovered by 50% from the lowest level which created a huge tail on the candle.

If by the end of this month the Candle closes not below 7169$, then there is a good chance bitcoin will continue moving upwards despite the fact of the huge crash (-54%).

Why? Because based on the technical analysis, if the candle body closes above the latest candles bodies (pic below), the bull signs are clearly showing that are on the winning the fight against the Bears.

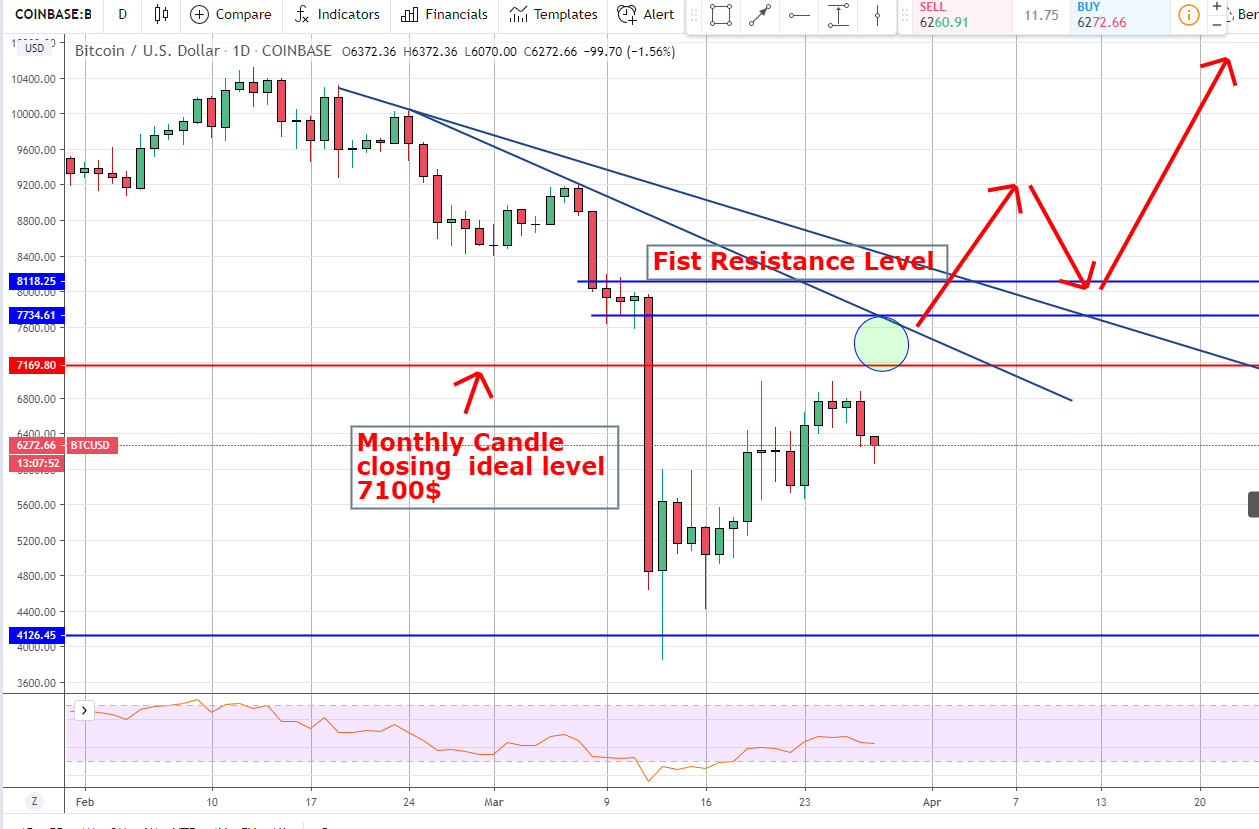

The weekly Chart:

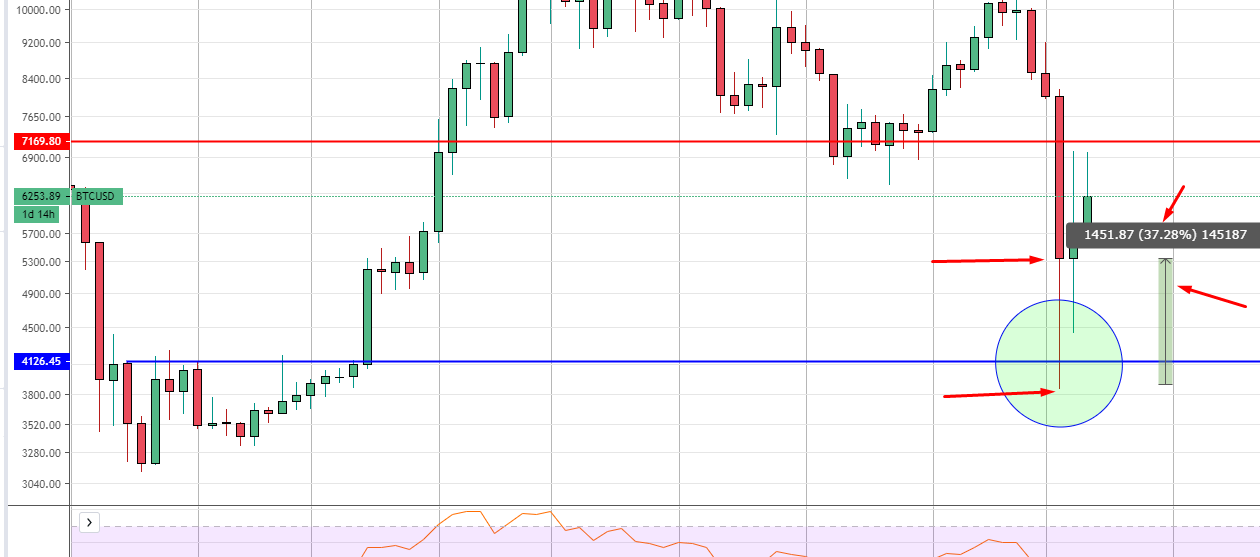

On the weekly chart we can clearly see that the crash stopped on the 4000$’s Demand Levels from where it pushed all the way up. To be exact, 37% within 2-3 days.

The weekly candles show strong signs to continue moving upwards as there are no resistance levels until 6700$ level and candle bodies are quite firm.

If this week candle closes at least at current levels 6200$-6700$ then next week candle should continue growing.

Remember that we are very close for a monthly Candle closing at 7100$ which means weekly and monthly charts will support the trend growth.

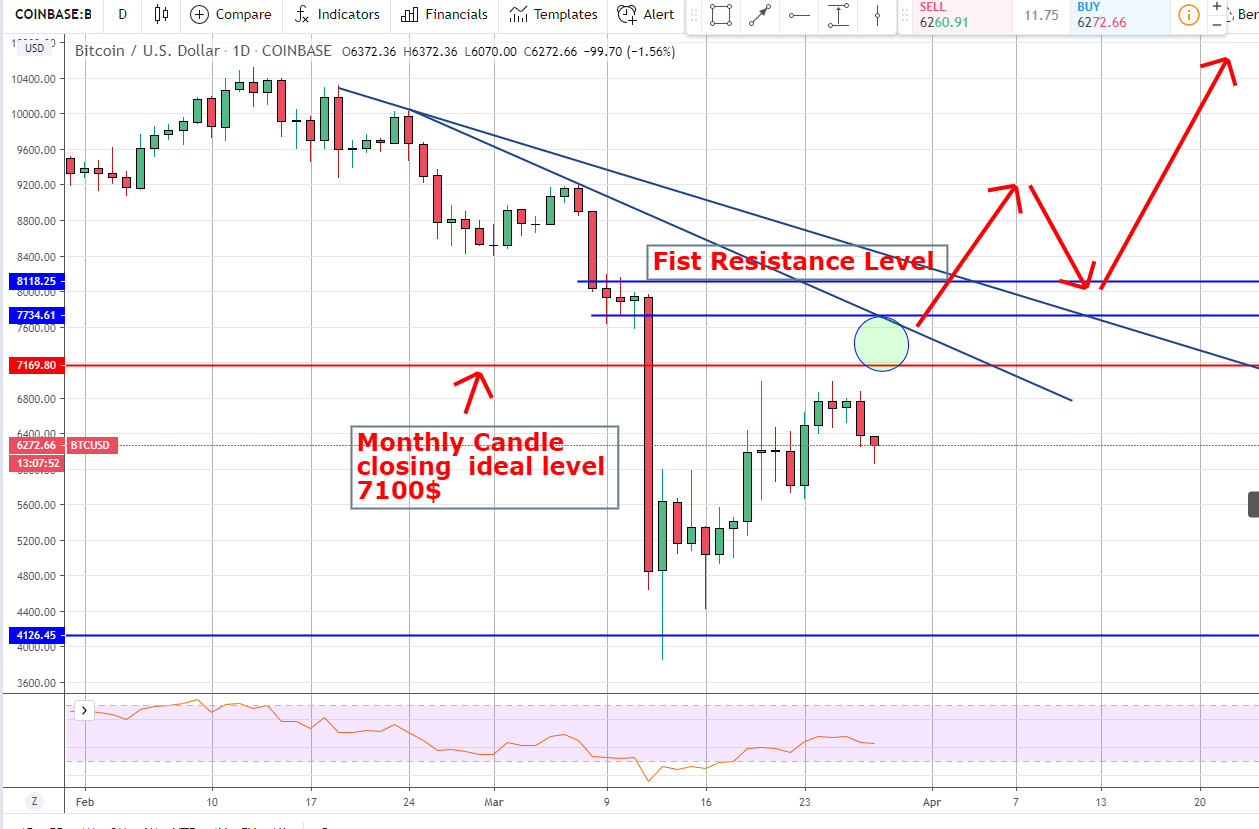

Daily chart:

The daily chart is growing based on support resistance growing trend. Here we can see that the first resistance level starts from 7700$-8100$ levels which means that the trend has no real obstacles to reach the monthly desired closing level by the end of this month.

And, if the price reaches those levels we will have, as said before, a monthly and weekly strong support for BTC to continue moving forward.

We will continue making analysis on a weekly basis.

Best of luck!

Haik Espina Galstyan